The San Antonio area was pounded with golf ball to baseball size hail last night. The pictures covering my social media pages of damage were crazy! Broken windows, shattered windshields, dented cars, holes in vinyl siding and damaged roofs.

This post is for those of you that are currently under contract to purchase a home anywhere in Texas.

Our in-house legal attorney, Jack Hawthorne at Keller Williams Heritage, has given us some great advice I’ll be sharing here. Your REALTOR® will be able to do this for you, permitting you used one to purchase the home.

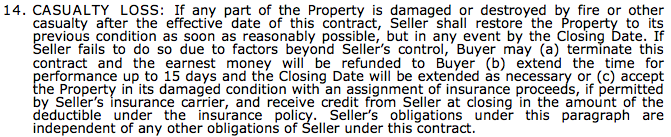

STEP 1: Read Paragraph 14 of the One to Four Family Contract!

Snapshot of Paragraph 14 of the Texas Real Estate Commission One to Four Family Residential Contract (Resale)

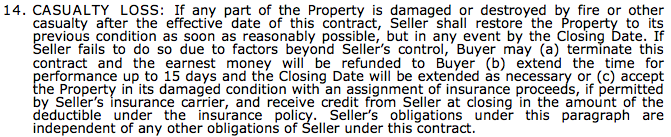

Snapshot of Paragraph 14 of the Texas Real Estate Commission One to Four Family Residential Contract (Resale)

STEP 2: Determine whether Seller can fix the issue.

STEP 3(A): Seller can fix by closing. Great! Detail that it will be done in an amendment.

STEP 3(B): Seller cannot fix by closing.

Your buyer can:

1)Terminate the contract and get earnest money back.

2) Unilaterally extend closing by up to 15 days to give Seller time to fix the issue. (You will need to document this in an amendment).

3) Accept the Property in its damaged condition with an assignment of insurance proceeds, if permitted by Seller’s insurance carrier, and receive credit from Seller at closing in the amount of the deductible under the insurance policy. (You will need to document this in an amendment).

EDIT* 3) is not a likely solution as insurance companies do not like to do this.

This type of advice is just another reason why I love working for such a great company like Keller Williams Realty. We strive daily to be the best REALTORS® we can be, and want to service our clients at the highest level possible. The support that our Broker gives us on a daily basis can’t be matched.

Know that when you’re ready to buy or sell, you’ll be in great hands.

Patricia Chavez, CCIM, ABR, MRP, e-Pro

Residential, Commercial and Military Relocation REALTOR®

Keller Williams Heritage

(210) 504-9920